NAIROBI, November 2 – Cash-strapped Kenya Railways Corporation (KRC) is seeking to turn around its fortunes by tapping into its vast but idle fixed assets that runs to billions of shillings.

KRC recently invited a tender bid for property development worth $300 million (about Sh2.4 billion) on 76 acres in Nairobi, officially activating its turnaround plan launched three months ago.

In the same breath, the State Corporation has put up 12 properties in Nairobi, Nakuru and Kisumu for sale and is in the process of renovating some 600 units with an aim of renting them out. The houses fell vacant following the retrenchment of workers since November 1, 2006 when the rail operations were handed over to a private investor.

Rail officials say the lease/part sale is the first in a series of actions aimed at restructuring the State Corporation.

Interested bidders for the development of the prime property, dubbed Golf City, will be required to show proof that they can finance the project under an equity arrangement, a Build-Operate-Transfer (BoT), or on long term franchise arrangement. Bidders who qualify will be required to commence development of the project within 12 months of granting the lease and complete development within a six year period.

The Golf City project will comprise a 100-roomed five-star hotel, a 600-roomed four-star hotel, conference facilities, an iMax theatre and an ultra modern railway line linking the premises to the Jomo Kenyatta International Airport.

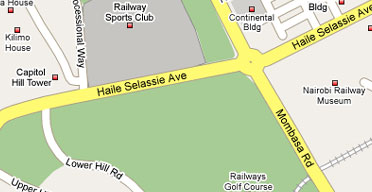

The project will be located on the east of Haile Selassie Avenue and will extend to the Railway Club on the western side of the same street up to the Uhuru Highway junction.

Also included in the plans is the construction of a shopping mall, exhibition rooms, a nine hole golf course, parking facilities for up to 2,000 cars and top-of-the-range exclusive cottages.

KRC says the 12 properties which have been put up for sale in Kisumu, Nairobi and Nakuru were re-evaluated by both government and independent valuers to “realise the true market prices” and invited buyers “to test market response”.

At disposal are number of properties which previously housed employees but which are now vacant following the restructuring of the workforce .Over the last two years the once dilapidated leaky premises have been spruced up and are being rented out at market rates to improve the corporation’s cash flow.

Plans are also at an advanced stage to initiate a project similar to Golf City in Kisumu.

The corporation said it would soon invite bids for a Sh20 billion project called Lake View Resort on its 20 acre land on the shores of Lake Victoria.

The project is to be situated at a site enclosed by Jomo Kenyatta Highway, Bank Street, Railway Station and State Lodge. It will involve the development of a five-star hotel with 400 rooms, two three-star hotels with 300 rooms each, a shopping mall and a business process outsourcing park.

It will also provide an office park with a capacity for 10 commercial vehicles, a car park for 2,000 cars and entertainment and recreation areas.

The investment opportunity announcements are part of a wider plan to sell some property and use the proceeds to add value to the huge parcels of land owned by the corporation. The corporation still has a great burden from the past – approximated at Sh31 billion including a high pension deficit to its workers’ scheme which stood at Sh12.8 billion during takeover of operations by new private rail managers operating under the Rift Valley Railways (RVR) banner.

The projects put forward are aimed at testing investor response and lay the ground for more sales in future to offset debts and implement planned projects outlined in a blue print unveiled a couple of months ago.

In the long term, the corporation aims to use the increased cash inflows to offset creditors’ dues and carry out its mandate guided by a recently launched Sh93 billion master plan.

The Plan aims at directing all resources and efforts towards a world-class provider of rail and inland waterways transport through effective management of the concession and achieving maximum return from its non-conceded assets.

When complete, the plan outlines initiatives to modernise rail transport in the country and open up East Africa to the world. It envisages KRC conforming to global trends where inter-city goods and passenger traffic moves by electric trains as opposed to motor vehicles.

KRC board chairman Jonathan Mturi says the development presents his board with an opportunity to re-invent themselves and to facilitate the delivery of railway services to support Kenya’s economic recovery and future expansion. “We aim at repositioning KRC as an innovative and creative organisation that utilises its resources efficiently for the good of the country and the region,” he says.

The Vision 2050 master plan has been endorsed by land locked countries in the region and KRC says plans are underway to form similar consultative groups in Ethiopia, Uganda, Tanzania, Uganda, Rwanda and Burundi to prepare the ground for the realisation of the drive that will connect countries in the region including Sudan and Djibouti. KRC presents their vision taking into account the growing population and economies of the region that translate into future demands.

Although privatised, current inefficiencies of the Kenya Railways systems are seen to have a negative impact on transport of goods and are also magnificent on the roads infrastructure that cannot cope with the increasing shift of traffic from rail to road, to many parts of the country and also to the landlocked countries within the East and Central Africa region. The transport ratio is as of now less than 15 per cent (for rail) to more than 85 per cent (for road).

For example it is expected that the population of the countries served by Mombasa port i.e. Kenya, Uganda, Tanzania, Southern Sudan, Rwanda, Burundi, Democratic Republic of Congo, Ethiopia and Somalia currently estimated at approximately 300 million will reach almost 500 million in 2050. This population growth together with the economies’ growth will inevitably increase the demand for railways transport.

One of the improvements proposed by KRC is the adoption of the standard gauge (1435mm) because it is safer, faster and more reliable.

It is expected that with the introduction of this gauge, the costs of transport and logistics will drop to between 15 per cent and 20 per cent and hence will support rapid industrialisation and economic growth.

At a recent visit to China by a high powered delegation – led by the Prime Minister Raila Odinga, a Chinese investor pledged a free feasibility study on the Mombasa-Kampala section of the railway as a commitment that it is ready to invest in it. On the other hand, Russia has shown interest in the Addis Ababa-Moyale section while France and South Africa are among countries said to be eying key sections of the rail network.

After many years of decline in the overall performance of Kenya Railways, a decision was made to concession freight and passenger services. This was implemented with the signing of the Concession Agreement between the Government of Kenya, Kenya Railways and the Concessionaire – Rift Valley Railways (K) Ltd. Following the signing of the agreement rail transport operations were handed over to the concessionaire on November 1, 2006; freight services for 25 years and five years for passenger services.

The role of KRC in this new arrangement is to manage the Concession Agreement and other railway assets. This important milestone in the history of KRC necessitated that a new strategic direction be put in place to support the changed mandate. The new KRC Strategic Plan for the period 2006 -2011(revised January 2007) is expected to enable KRC to chart out its future and fulfil its mandate in the post-concession phase.